Fintech and Sustainability: Paving the Path towards a Greener Future in India

From disruptive innovations to game-changing initiatives, this era is witnessing a powerful global shift towards sustainability and the pressing need to confront environmental issues head-on. The transformative wave of digitalisation and sustainability has now reached the realm of fintech, where technology, innovation, and data converge to reshape the financial landscape and address sustainability challenges on a global scale. This driving force of adaptability and digital transformation of fintech sector is moulding India's path towards a sustainable future.

With a current valuation of $150 billion, projected to double to $300 billion by 2025, the Indian fintech industry is on an extraordinary growth trajectory. This growth is fueled by factors such as the widespread availability of mobile internet, a burgeoning middle class, and the government's commitment to financial inclusion. Additionally, fintech is actively shaping positive behavioural changes by promoting sustainable consumer choices, empowering carbon footprint tracking, fostering responsible financial management, and bolstering support for sustainable businesses.

In India, fintech startups are leading the charge by seamlessly integrating financial services with cutting-edge technologies like artificial intelligence, blockchain, and machine learning. These visionary companies are crafting sustainable finance models tailored to India's unique needs. Through digital platforms, they offer incredible opportunities for green investments, crowdfunding renewable energy projects, micro-lending for sustainable agriculture practices, and much more. These disruptive fintech solutions democratise access to sustainable finance, drive financial inclusion, inspire eco-friendly habits, and empower informed decision-making, all contributing to a more sustainable and inclusive Indian economy.

This blog aims to delve into the myriad dimensions of this remarkable synergy, shedding light on the inspiring fintech-driven initiatives propelling India towards a greener, more sustainable future.

Ways in Which Sustainability Fuels Fintech's Ethical and Social Impact in India

Sustainability is also a top priority for the Indian government. In 2020, India pledged to achieve net-zero emissions by 2070. To achieve this goal, the government is investing in renewable energy, energy efficiency, and other sustainable initiatives. The convergence of fintech and sustainability is creating new opportunities for businesses and individuals in India to contribute to a more sustainable future. Fintech is being used to:

- Educate consumers about sustainable financial investment, products, and services.

- Provide access to financial services to underserved populations.

- Channel capital for sustainable projects.

- Reduce the costs of financial transactions.

- Improve transparency in the financial system.

10 Sustainable Fintech Trends in 2023

Digital payment technology offers convenience and security while also aligning with consumers' growing interest in sustainability. Both the finance and fintech industries are actively promoting sustainability and green awareness through various methods. In 2023, there will be ten notable sustainable fintech trends that contribute to sustainability:

- Open banking: Open banking is a financial practice that allows customers to share their banking data securely with third-party providers, enabling innovative services and personalised experiences. It promotes competition, transparency, and customer control over their financial information, fostering a more connected and efficient financial ecosystem.

- Environmentally friendly cryptocurrencies: To address concerns about the energy consumption of traditional cryptocurrencies like Bitcoin, fintech leaders are exploring alternative technologies with lower energy requirements. Green cryptocurrencies, which utilise consensus mechanisms and proof-of-stake algorithms, offer more sustainable investment options.

- Digital wallets to reduce waste and emissions: Digital wallets provide an eco-friendly payment alternative, reducing paper and plastic waste. Users are increasingly adopting mobile wallets that often prioritise renewable energy sources and sustainable infrastructure, supporting environmental causes.

- Contactless payments for sustainable transportation: Contactless payments eliminate the need for cash or paper tickets on public transportation, reducing paper usage and its environmental impact. They also facilitate access to bike- and scooter-sharing services, promoting alternative transportation methods.

- Carbon-neutral payment processing methods: Carbon-neutral payment processing involves offsetting carbon emissions through renewable energy projects or carbon offset programmes, achieving a net-zero carbon footprint. Payment processors can adopt energy-efficient technologies, support carbon offset initiatives, and utilise renewable energy sources to mitigate environmental effects.

- Mobile payment solutions for carbon offset: Mobile payment solutions allow users to offset carbon emissions resulting from transactions by supporting renewable energy projects or reforestation efforts. Applications like TreeCard and Doconomy enable individuals to track their carbon footprint, make eco-friendly financial decisions, and contribute to climate change efforts.

- Carbon tracking: Carbon tracking technology helps monitor carbon emissions, a crucial step in achieving global environmental goals. Digital solutions, including blockchain, enable real-time tracking of CO2 emissions, allowing businesses to effectively manage their carbon footprint and implement proactive measures to reduce their environmental impact.

- Green investment: Fintech companies are developing digital solutions to address environmental issues, and industry leaders are investing in sustainable initiatives like renewable energy. Global green investments reached $495 billion in 2022, a 17% increase from 2021, facilitated by digital platforms supporting eco-friendly initiatives.

- Digital payments and signatures: The rise of digital payments, electronic signatures, and mobile banking reduces the environmental impact of conventional banking methods such as cash, checks, and paper statements. This shift towards fully digital banking not only offers convenience but also contributes to more sustainable financial operations.

- Green loans and sustainable finance: Financial institutions can create loan products that incentivize businesses to prioritise sustainability. These loans may provide benefits such as lower interest rates or other incentives for companies investing in energy-efficient technologies or sustainable agriculture, encouraging more sustainable practices.

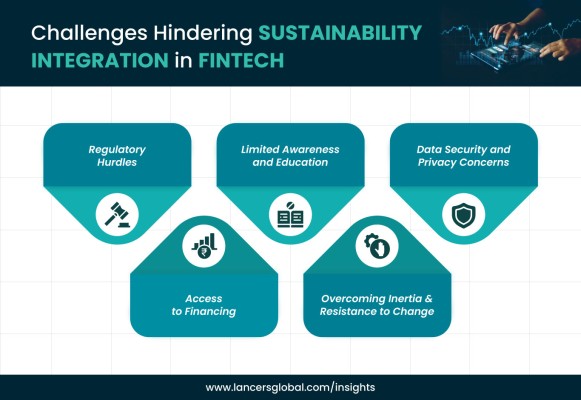

Challenges Hindering Sustainability Integration in Fintech

While the fintech sector holds immense potential for driving sustainability, there are several challenges that must be overcome to fully establish sustainable practices. Let's explore some of the key challenges faced in integrating sustainability into the fintech sector.

-

Regulatory Hurdles

One of the primary challenges in establishing sustainability in the fintech sector is navigating complex and evolving regulatory frameworks. Regulations often lag behind technological advancements, making it difficult for fintech companies to operate in a sustainable manner. There is a need for clear and comprehensive regulations that encourage sustainable practices while ensuring consumer protection and financial stability.

-

Limited awareness and education

Another obstacle is the limited awareness and understanding of sustainability among fintech companies and consumers alike. Many players in the sector may not fully comprehend the potential impact of their activities on the environment or lack the knowledge to integrate sustainable practices into their operations. Raising awareness and providing education about the benefits and methods of sustainable fintech is crucial to driving meaningful change.

-

Data security and privacy concerns

Sustainability in fintech often relies on data collection and analysis to assess environmental impacts and make informed decisions. However, this raises concerns about data security and privacy. Balancing the need for data transparency with ensuring the protection of sensitive information poses a significant challenge. Fintech companies must adopt robust data protection measures and ensure compliance with privacy regulations to gain trust and promote sustainable practices.

-

Access to Financing

Sustainable fintech initiatives require sufficient funding to develop and scale their operations. However, accessing financing for sustainable projects can be challenging. Traditional financing institutions may be hesitant to invest in emerging technologies or unproven business models, limiting the availability of capital for sustainable fintech ventures. Encouraging the development of dedicated green financing mechanisms and promoting collaboration between investors and sustainable fintech startups can help overcome this challenge.

-

Overcoming Inertia and Resistance to Change

Establishing sustainability in the fintech sector requires a shift in mindset and practises. Resistance to change and inertia within existing financial institutions and regulatory bodies can hinder the adoption of sustainable fintech solutions. It is essential to foster collaboration and dialogue among stakeholders, encouraging the sharing of best practises and success stories. Building coalitions and partnerships that promote sustainability can help overcome resistance and drive widespread adoption.

How Does Sustainability Help Transform Fintech Business Models?

By leveraging innovative technologies and sustainable business models, green finance offers numerous benefits to the fintech sector. In this section, we will discuss the key advantages of green finance for the fintech industry:

-

Market Opportunities and Competitive Advantage:

Green finance opens up new market opportunities for fintech companies. By aligning their services and solutions with sustainability goals, fintech firms can tap into the growing demand for environmentally conscious financial products and services. Adopting green finance practises can give fintech companies a competitive edge by attracting socially and environmentally conscious customers and investors.

-

Enhanced Risk Management:

Green finance emphasises environmental risk management, which is crucial for the long-term viability of financial institutions. Fintech companies that incorporate green finance principles can better assess and manage environmental risks in their operations and investment portfolios. By integrating environmental risk factors into their risk management frameworks, fintech firms can enhance their resilience and minimise the potential negative impacts of climate change and other environmental challenges.

-

Cost reduction and efficiency:

Green finance encourages the adoption of sustainable technologies and processes, which can lead to cost reductions and increased efficiency for fintech companies. By leveraging advanced technologies like blockchain, artificial intelligence, and data analytics, fintech firms can streamline their operations, reduce resource consumption, and optimise energy use. These efficiency gains translate into cost savings and improved profitability, making green finance a smart business strategy.

-

Access to Green Funding:

One of the significant benefits of green finance for the fintech industry is improved access to green funding sources. Green bonds, sustainable investment funds, and impact investors are increasingly focusing on supporting fintech ventures that align with environmental goals. Fintech companies that demonstrate a commitment to sustainability and incorporate green finance principles are more likely to attract funding from these sources, enabling them to scale their operations and drive innovation in the sector.

-

Positive brand reputation and customer loyalty:

Integrating green finance practices can enhance a fintech company's brand reputation and foster customer loyalty. Consumers, particularly the younger generation, are increasingly conscious of the environmental impact of their financial choices. Fintech firms that prioritise sustainability can build trust and credibility among environmentally conscious consumers, leading to long-term customer loyalty. A positive brand reputation associated with green finance can also attract partnerships and collaborations with other like-minded organisations.

-

Alignment with Global Sustainability Goals:

Green finance aligns fintech companies with global sustainability goals, such as the United Nations Sustainable Development Goals (SDGs) and the Paris Agreement. By integrating green finance principles, fintech firms contribute directly to addressing climate change, promoting renewable energy, and supporting sustainable economic development. This alignment enhances the social and environmental impact of the fintech industry, positioning it as a catalyst for positive change.

-

Enhancing financial inclusion:

Fintech can help expand access to financial services for people who have traditionally been excluded from the financial system, such as those in rural areas or those with low incomes. This can help reduce poverty and inequality, which are major challenges to sustainability.

Conclusion

In conclusion, the intersection of fintech and sustainability in India presents a promising path towards a more inclusive, responsible, and resilient financial ecosystem. Despite the challenges faced, the benefits of embracing sustainability in fintech are substantial. The trends, including the rise of green finance and open banking, indicate a growing recognition of the need for sustainability in the industry. By harnessing these trends, addressing the challenges head-on, and leveraging the benefits, India's fintech sector can play a pivotal role in advancing sustainable development goals, creating long-term value, and shaping a brighter future for all. It is crucial for stakeholders, including government bodies, financial institutions, and fintech companies, to collaborate and navigate this landscape with a shared vision of building a sustainable and inclusive financial future for India. Through innovation, collaboration, and a purpose-driven approach, fintech can pave the way for a more sustainable and equitable India.

Recent Posts

Add Comment

0 Comments